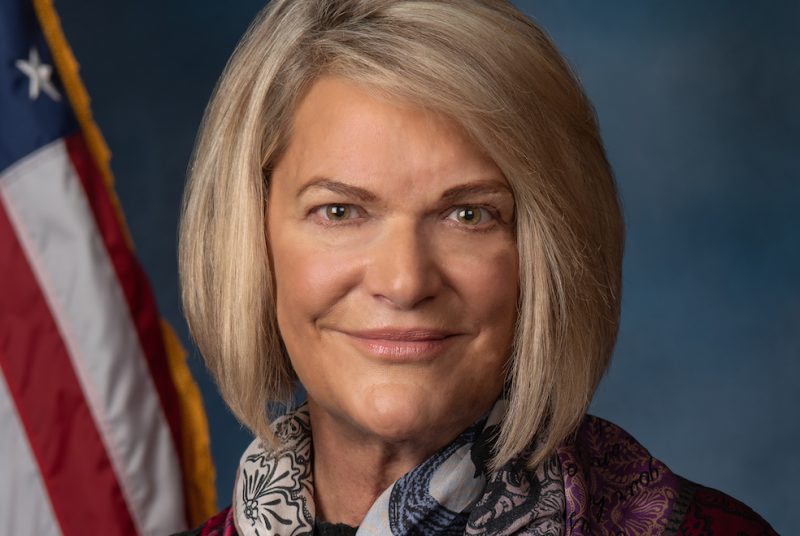

The Biden administration is picking “winners and losers” in a proposal to tax cryptocurrency miners, US Sen. Cynthia Lummis said in a tweet on Thursday.

The Wyoming Republican called Biden’s proposed 30 percent tax a “blatant attempt by the administration to pick winners and losers.”

“I will not let President Biden tax the digital asset industry out of existence,” Lummis said.

Lummis first pushed back against the tax proposal last week at the in Miami.

She said to the crowd about the tax,” that isn’t going to happen.”

Lummis also tweeted on Friday about the conference.

“America must welcome innovation and digital assets are the future of financial innovation,” Lummis tweeted.

Unpacking the tax

The Biden Administration proposed what is dubbed the Digital Asset Mining Energy excise tax, or DAME, in its budget for fiscal year 2024 .

Under that proposal, firms would contend with a tax equal to 30 percent of the cost of the electricity used.

The tax would be implemented next year and phased in gradually over a period of three years at a rate of 10 percent a year to then reach the target 30% rate by the end of 2026, according to previous .

Bill loading

Lummis along with Democratic Sen. Kirsten Gillibrand of New York, has said the Responsible Innovation Act will be reintroduced in the next month, with some changes including adding in more customer protections.

The bill, which takes a comprehensive approach to regulating crypto, was introduced last year.

The bipartisan pair is working with House Financial Services Committee Chair Patrick T. McHenry, R-N.C., and Maxine Waters, D-Calif., on potentially breaking the bill apart into different committees to get it passed, Lummis said at the conference last week.

“What we’re apt to see is for the House to move a stablecoin bill first, then you’ll probably see the introduction of Lummis Gillibrand in the Senate, which will remain comprehensive,” Lummis said at the bitcoin conference.

Lummis clarified when asked whether she was waiting to introduce her bill until the stablecoin bill is worked through the House.

“We are not,” Lummis said.